📱 How Android Is Revolutionizing Mobile Banking and Forex Trading in the Digital Age

🌍 Introduction: Finance in Your Pocket

In an increasingly mobile-driven world, smartphones have become indispensable tools for managing our daily lives — and nowhere is this more apparent than in the realm of personal finance. With Android devices dominating the global smartphone market, they play a central role in reshaping how individuals engage with banking services and the Forex (foreign exchange) market.

Thanks to the rapid development of mobile apps, what once required desktop access or in-person banking is now available with a few taps on a touchscreen. From sending money across borders to trading currencies in real time, Android devices empower users with unprecedented financial freedom and control.

💳 Mobile Banking on Android: A New Standard for Everyday Finance

🏦 Core Features that Matter

Mobile banking apps on Android provide full access to essential banking functions. Users can:

- View real-time account balances

- Make instant domestic or international transfers

- Pay bills, set up recurring payments

- Deposit checks using mobile capture

- Manage multiple accounts from a single dashboard

Banks like Chase, Bank of America, Revolut, and Monzo have invested heavily in Android apps that are not only feature-rich but also user-friendly and secure.

🧠 Smart Finance Management on the Go

Today’s mobile banking apps go far beyond basic transactions. Android users benefit from:

- Automated budgeting tools

- Expense categorization and notifications

- Savings goal trackers

- Cashback and rewards integration

- Spending insights using AI-based analytics

By consolidating financial information in one place, Android-based mobile banking helps users make better decisions and avoid financial pitfalls.

📈 Forex Trading on Android: Real-Time Access to a 24/7 Market

🌐 Why Mobile Matters in Forex

The Forex market is the largest and most liquid financial market in the world, operating 24 hours a day, five days a week. In such a fast-paced environment, speed and access are critical.

Android apps developed by top brokers like MetaTrader 4/5, eToro, XTB, IG, and Plus500 provide robust mobile platforms for:

- Monitoring currency pair fluctuations

- Executing trades in real time

- Applying technical indicators

- Accessing live news and economic calendars

- Managing open positions and risk

📊 Real-Time Analytics & Alerts

Forex apps on Android often include:

- Custom price alerts

- Push notifications for volatility spikes

- Integrated trading signals

- In-app live chat with brokers or support

With Android, Forex trading becomes highly accessible — even for beginners. Whether you’re at home, commuting, or traveling abroad, the market is always in reach.

🔐 Security in Mobile Finance: Android’s Role in Safe Transactions

Security remains a top concern for mobile users, especially when it comes to financial operations. Fortunately, Android has evolved to support a range of security features that make both mobile banking and Forex trading safer.

🔒 Key Security Features

- Biometric authentication (fingerprint, facial recognition)

- Encrypted app communication

- Two-Factor Authentication (2FA) and Multi-Factor Authentication (MFA)

- Device-level sandboxing and permission control

- Remote wipe and Find My Device options for stolen phones

Banks and brokers further enhance these protections with in-app security measures like device authorization, secure PINs, and login timeouts.

🧮 Budgeting, Investment, and Wealth Tracking on Android

Beyond banking and trading, Android users have access to a robust ecosystem of financial apps that support broader wealth management goals.

🔧 Top App Categories Include:

- Budgeting apps (e.g., Mint, YNAB, Goodbudget)

- Investment platforms (e.g., Robinhood, Stash, Webull)

- Crypto wallets and exchanges (e.g., Coinbase, Binance)

- Tax and accounting tools (e.g., QuickBooks, TurboTax)

These apps sync with bank accounts, categorize spending, visualize net worth, and help plan for taxes or retirement — all from a mobile interface.

🌟 Advantages of Android Over Other Platforms

While iOS remains a major player, Android offers unique benefits for mobile finance:

- Wider range of devices and price points (accessible to more users globally)

- Customizable app experience (widgets, launchers, automation)

- Deeper integration with Google ecosystem (e.g., Google Pay, Google Sheets for budgeting)

- Higher flexibility for third-party apps and brokers

These aspects make Android the platform of choice for many financial app developers and users alike.

📊 Android and the Financial Inclusion Revolution

One of the most transformative impacts of Android-based mobile banking and Forex access is financial inclusion. In many developing countries, people lack access to physical bank branches or investment firms — but they do have smartphones.

With mobile-first fintech platforms like M-Pesa, Paytm, and GCash, Android devices are giving millions access to:

- Savings and credit products

- International remittances

- Currency exchange services

- Basic investment opportunities

This shift is closing the gap between the banked and unbanked population, helping people build wealth and resilience from the ground up.

✅ Conclusion: Android’s Financial Revolution Is Just Beginning

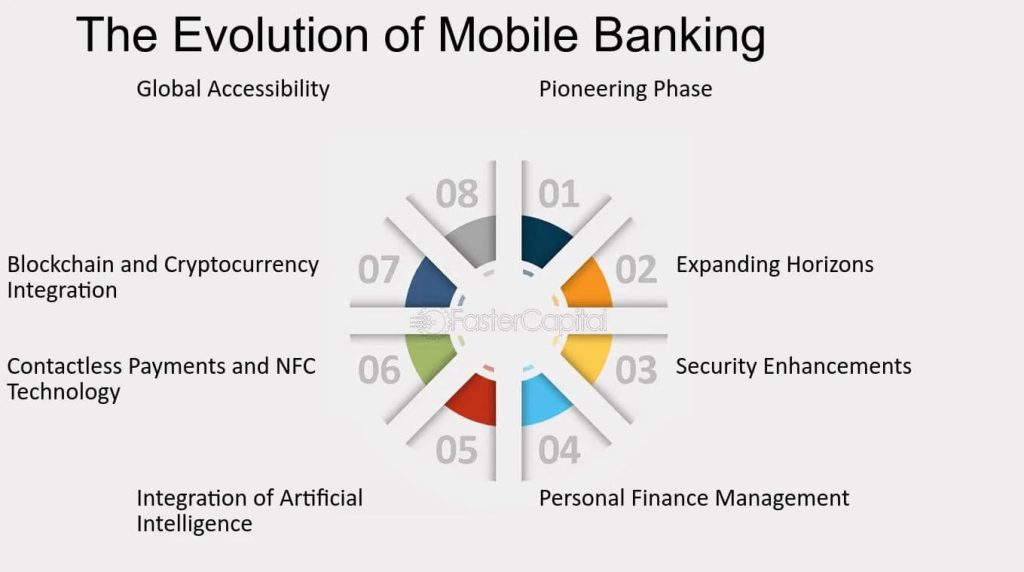

Android has fundamentally changed the way we engage with our finances. From checking your balance while waiting in line to executing a Forex trade during your commute, Android empowers users to stay in control.

The future of personal finance lies in mobility, intelligence, and security — and Android is leading the charge.

As mobile banking apps and Forex platforms continue to evolve, we can expect even more integration with AI, blockchain, and open banking protocols, giving users deeper insight and control over their financial lives.

In the digital age, financial independence is no longer tied to a desk. Thanks to Android, it fits in your hand.